When the lights dim for movie night, a family isn’t just watching �a film—they’re creating memories that can span generations. �This emotional connection represents an opportunity for marketers.

Despite the perception that theater-going is waning, 3 in 4 people in America visited theaters last year and even more are watching at home, according to a new study from Amazon Ads and Crowd DNA.

Movies create lasting connections between brands and families. When brands integrate naturally into this journey, rather than interrupting it, they become part of the story. Movies spark conversations between parents and children, or foster bonds between friends discovering films together. The most effective campaigns don’t feel like advertising at all. They feel like extensions of the movie experience itself, earning a place in memories that families pass down for years.

Parents are one of the most engaged audiences for movie-based marketing, often acting as bridges to the entire family. Some 63% of all moviegoers are parents, and 48% of moviegoers attend with their children, according to Fandango’s Moviegoing Trends & Insights Study Spring 2025.

Movies are for family connections—66% of parents watch movies to bond with their children, according to Amazon Ads and Crowd DNA.��

This behavior peaks when children are between ages 8 and 10 (at 77%), a prime window for co-viewing and shared fandom.��

Parents prioritize family outings over date night: 54% of parents took their last trip to the movies with their kids, surpassing even a date night with their partner (44%).

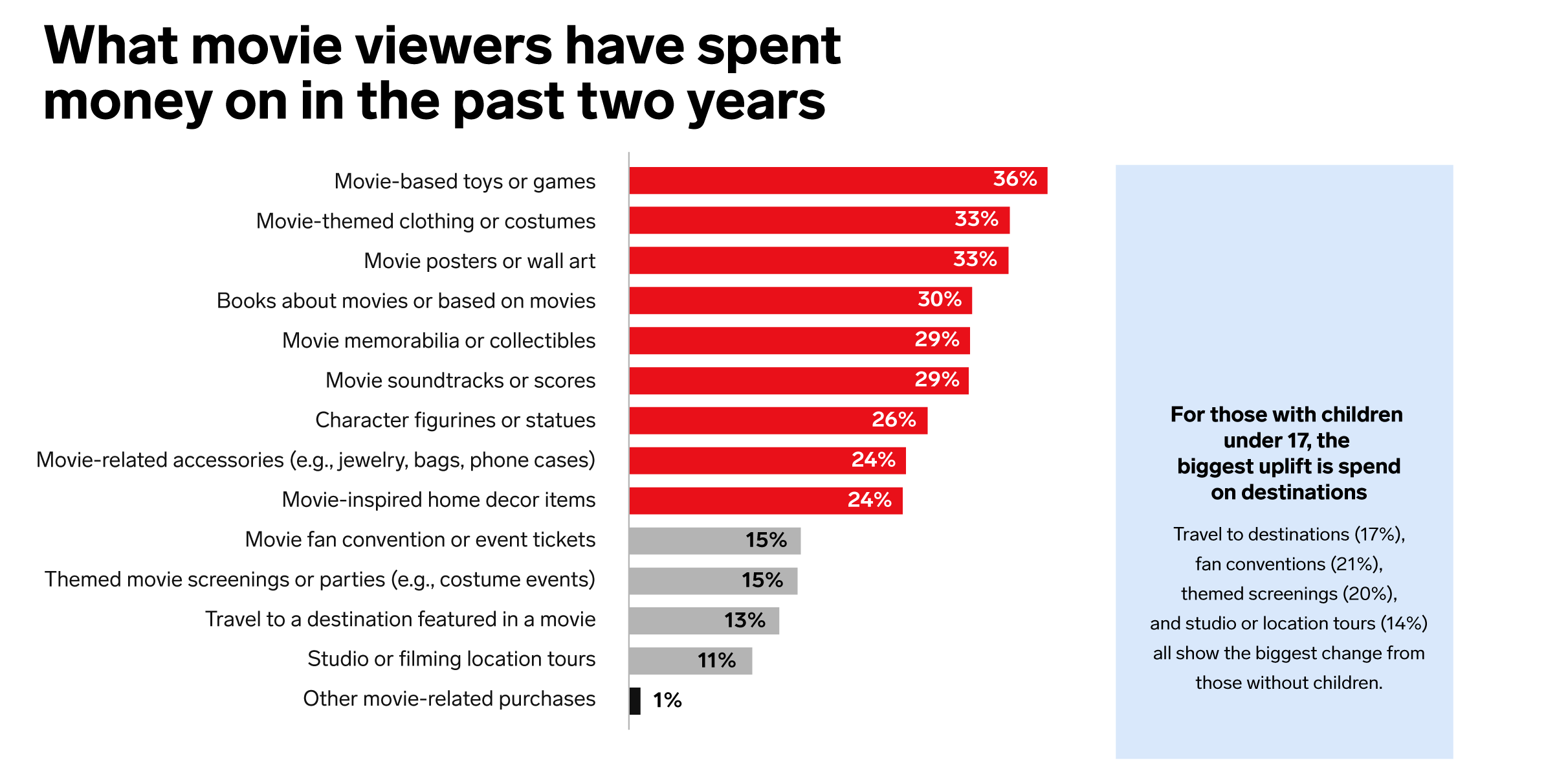

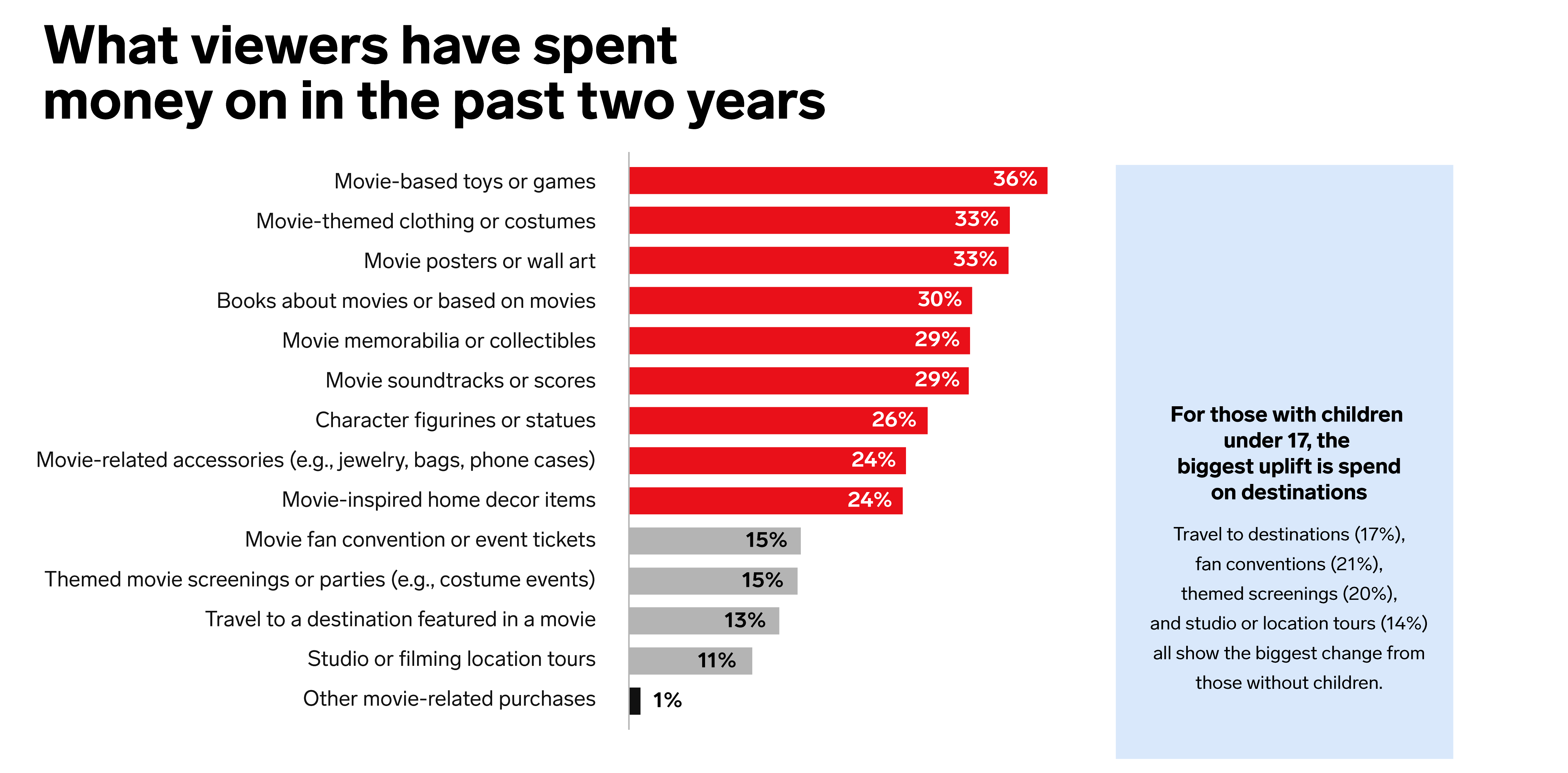

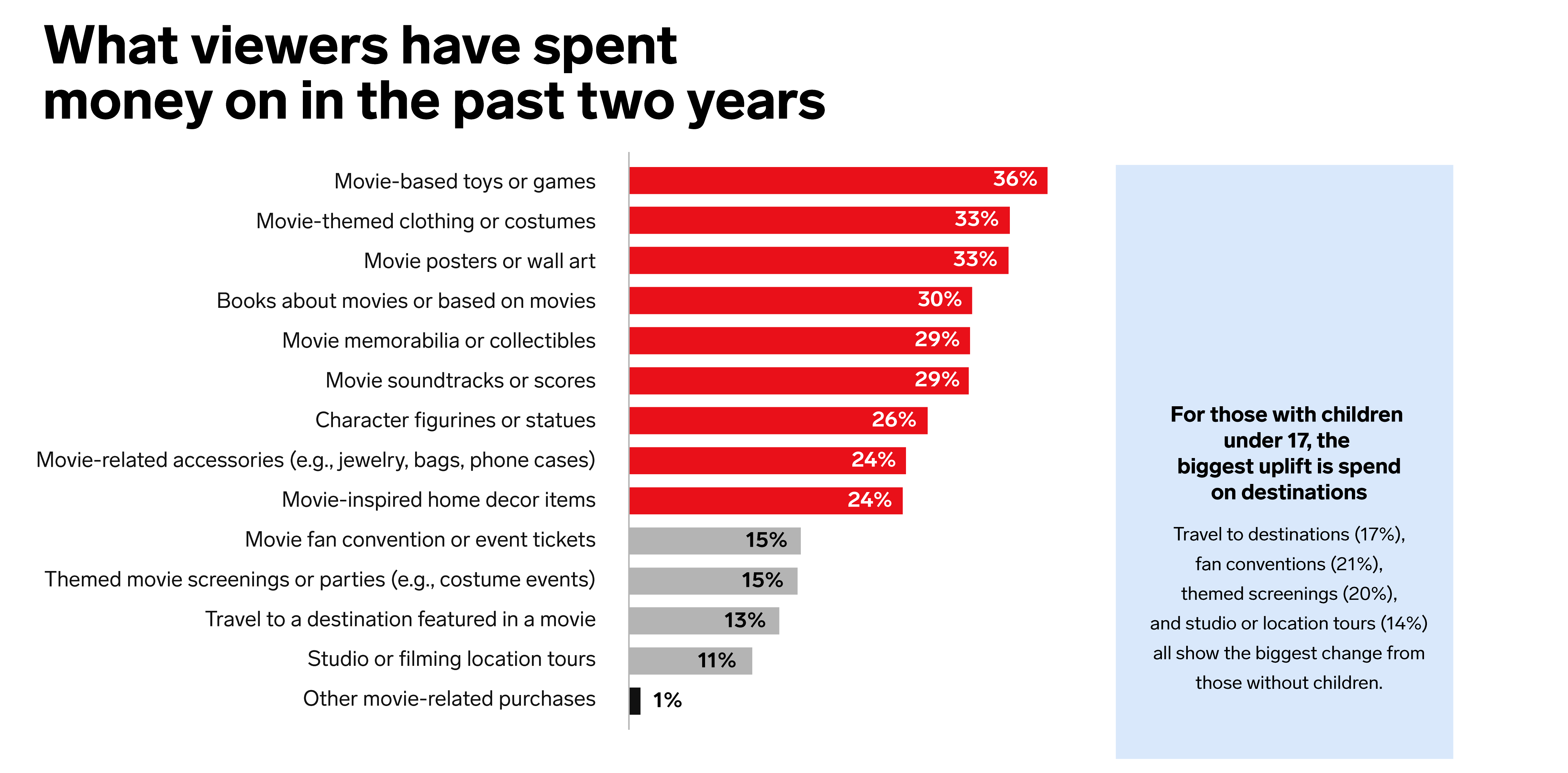

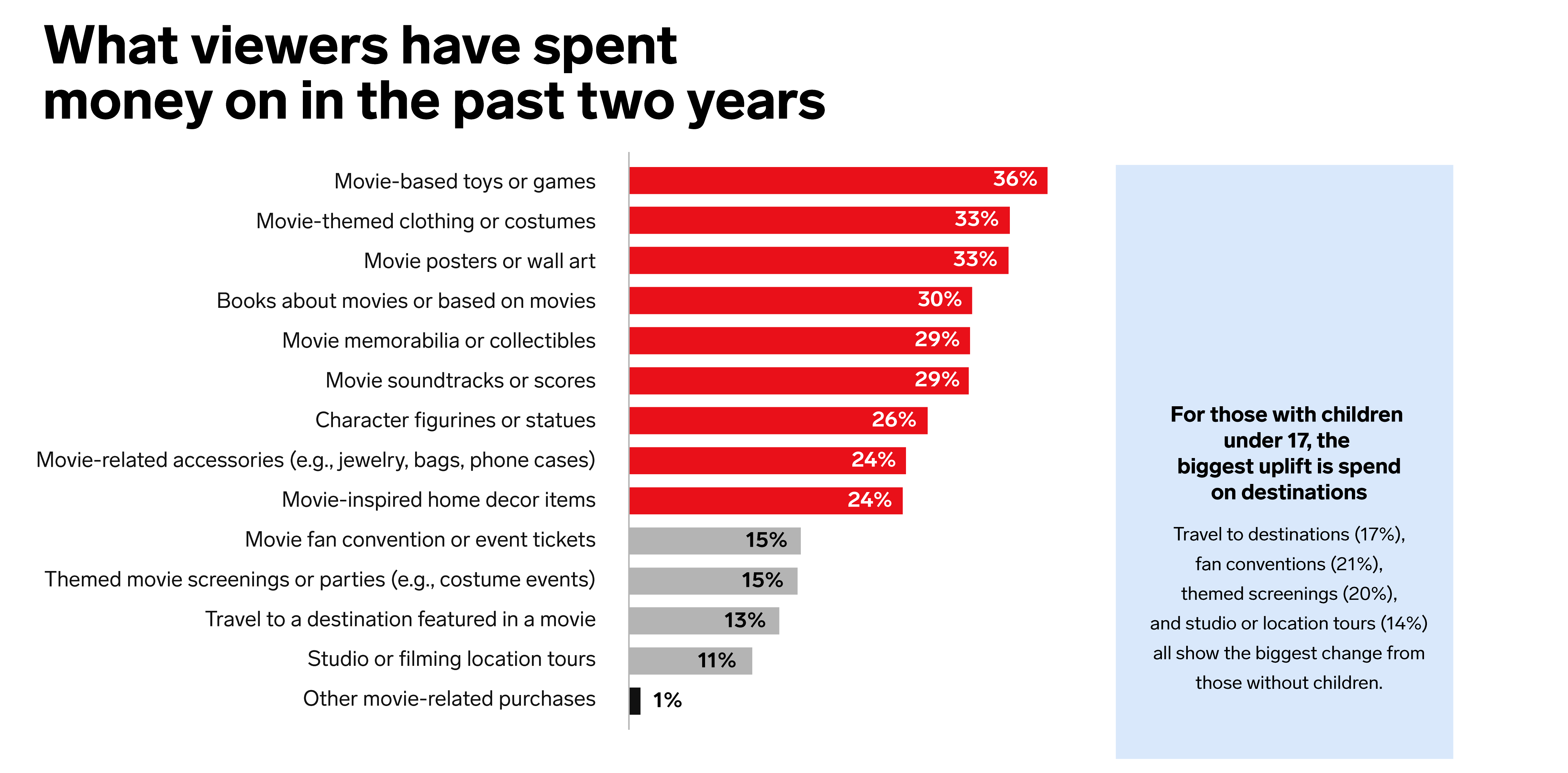

Movie fans often buy products related to movies they love, for themselves or for their kids. That’s a powerful response that creates opportunities for brands.

Parents are more likely to spend money from plane tickets to movie merch.

Parents spend an average of $242 annually on movie-related products like toys, clothing and memorabilia, nearly $50 more than the general population, driven largely by gifting for kids, according to Amazon Ads and Crowd DNA.�

72% of parents buy toys and games related to the movies their children watch.�

Those movie-related toy purchases happen most frequently for children aged 10-11.

Purchases are fueled �by emotional connections.

Movie memorabilia is a way parents can connect with their kids after the credits roll.�

82% of overall viewers make movie-related purchases for memory-making, nostalgia, or collection-building.�

66% buy products for gifting or self-expression.�

72% of those that have bought toys or games bought them for their children.

What products are movie fans most likely to buy?

36% toys and games

33% clothing and costumes

33% posters and wall art

Shoppable ad formats and brand collabs can help drive purchase decisions.

43% are more likely to buy a brand’s product if it’s linked to a franchise they love, the Fandom study found.

Collab examples include “Barbie” x Crocs, “Spider-Man” x Nike, and “Transformers” x 7-Eleven.

Fandom doesn’t fade after opening weekend—it stretches across years, even decades. This long-tail engagement gives brands and advertisers repeated opportunities to re-enter the conversation and convert fans into loyal customers.

Every touchpoint along a film’s journey—build-up, release, and long-term fandom—represents a potential opportunity for brands to connect with customers with content, toys, games, costumes, and more. The average franchise fandom spans 10.4 years, per Amazon Ads, which means the same viewer who loves a “Batman” action figure growing up may also be looking for a vintage comic book at age 20, or even a “Wonder Woman” costume for his child at age 30.

“Star Wars: The Phantom Menace” 25th-anniversary screening earned $8.1 million in one weekend, ranking No. 2 at the box office, despite being 25 years old.

Even in years with less movie buzz, fans are buying. In 2024, a year with fewer blockbuster films than the previous year, licensed toy sales grew 8%, representing 34% of the total toy market, according to Circana. Adults, especially parents, are buying movie-branded products and staying engaged—and spending—long after release.

The coronavirus pandemic slowed in-theater visits but watching at home skyrocketed. Movie fans diversified how they engage, with theater and at-home viewing offering distinct value, especially for parents. Advertisers should understand why and when viewers watch at home versus in the theater to match them with the right messaging.

The leading reasons for watching movies in theaters are social connection (47%), escape (39%), and immersion (38%), according to Amazon Ads and Crowd DNA.

Viewers also associate certain genres—action (66%), adventure (59%), and science fiction (54%) with theaters.

Adults are most likely to visit theaters with partners (38%), children (23%), or friends (19%).

Theaters are for immersive, social experiences.

Adults choose to watch at home for comfort (49%), free access (43%), and convenience (40%).

Documentaries (76%), romance (72%), comedy (66%), and drama (66%) are most associated with at-home viewing.

18+ at-home viewing is most likely to be alone (40%) or with a partner (37%) rather than with children (14%) or friends (8%).

Home viewing is for �comfort and control.

Even casual fans may rewatch, revisit online clips, watch sequels, and listen to soundtracks. Brands could also consider partnering with a toy company to build campaigns that span every channel where families shop and play. When the movie launches, your products are ready to purchase. The film drives toy sales. The toys extend the movie experience. Each reinforces the other, creating momentum that lasts long after the credits roll. While licensed toys were 32% of the total toy market in the first half of 2024, per Circana, that’s still 70% unlicensed, showing big opportunity for "newer" toy brands.

Movies move people—and wallets. By weaving your brand into those meaningful moments before, during, and long after the credits roll, you’re tapping into a multibillion‑dollar engine powered by nostalgia, family bonds, and fandom that spans decades. Treat every touchpoint—trailers, toys, playlists, re‑releases—as a chance to deepen that emotional connection, and you’ll convert casual viewers into lifelong brand advocates.

BROUGHT TO YOU BY

Movies offer a unique opportunity to make emotional connections across generations and throughout the fandom journey.

Build-up:

Spark demand during pre-release anticipation

This phase is about discovery and anticipation, which can extend to ads. Tactics like sponsored sneak previews, behind-the-scenes content, and curated watch guides build buzz ahead of a family movie night. Pre-roll ads and trailers catch excited viewers while families are in their seats paying attention.

Keep campaigns tailored to the specific movie or watch experience. Family-friendly movies are great to reach parents and children, while franchise action films may cater to older audiences but be shared nostalgically with children as they mature. Brands can engage with the build-up with Amazon Ads by leaning into Prime Video Ads to help increase reach and drive awareness.

Movie time is sacred, so advertisers must be thoughtful about interruptions. Brands can connect with Amazon Music playlists curated by directors or actors that they associate with the movie.

Then, consider tactics like amplifying fan voices or user-generated content from family-focused creators, appearing on internet deep dives and forums related to release to connect with parents searching for more movie info.

Release and early hype:

Connect with enthusiastic viewers

In the weeks, months, and early years after release, community engagement and merchandise surrounding are key. Engaged fans may pursue cosplay, content creation, and collection to express their love for the film, areas for advertisers to show up with sponsored merch or events. This is a great time for parents to share their passion, so make sure your activations include content accessible across generations.

Later ripples /ongoing effect:

Stay in touch with the fan community

Amazon Ads offers full-funnel advertising solutions to help businesses of all sizes achieve their marketing goals at scale. Amazon Ads connects advertisers to highly relevant audiences through first-party insights; extensive reach across premium content like Prime Video, Twitch, and third-party publishers; the ability to connect and directly measure campaign tactics across awareness, consideration, and conversion; and generative AI to deliver appropriate creative at each step. Amazon Ads helps advertisers reach an average monthly ad-supported audience of more than 300 million in the U.S. across Amazon's owned and operated properties and third-party publishers.

This white paper was produced for Amazon Ads by EMARKETER Studio, an in-house creative studio within research company EMARKETER. EMARKETER is the leading provider of research, data, and insights for marketing, advertising, and commerce professionals. Our data-driven forecasts and rigorous analysis empower revenue-driving teams to make strategic decisions with confidence. Through expert context from our analysts, carefully vetted data sources, and a proprietary research methodology, EMARKETER delivers forecasts, reports, and benchmarks that help companies anticipate tomorrow’s market trends today. EMARKETER is a division of Axel Springer S.E.

This behavior peaks when children are between ages 8 and 10 (at 77%), a prime window for co-viewing and shared fandom.

Parents prioritize family outings over date night: 54% of parents took their last trip to the movies with their kids, surpassing even a date night with their partner (44%).

Movies are for family connections—66% of parents watch movies to bond with their children, according to Amazon Ads and Crowd DNA.

Source: “The Ripple Effect,” Crowd DNA and Amazon Ads, May 2025

Note: Those have bought movie related products or experiences (n=1,933)