Lookbook

Commerce media is on track to surpass $100 billion in ad spending by 2028—

but its rise comes with growing pains. On-site retail media is nearing saturation, advertiser budgets are under strain, and nonretail players must work hard to get

noticed in a market dominated by a few retail giants.

In this Lookbook, EMARKETER explores three of the biggest challenges shaping commerce media today: scaling revenue beyond the basics, competing for limited ad dollars, and defining the path for nonretail players. These insights will help you understand the landscape and what it takes to stand out.

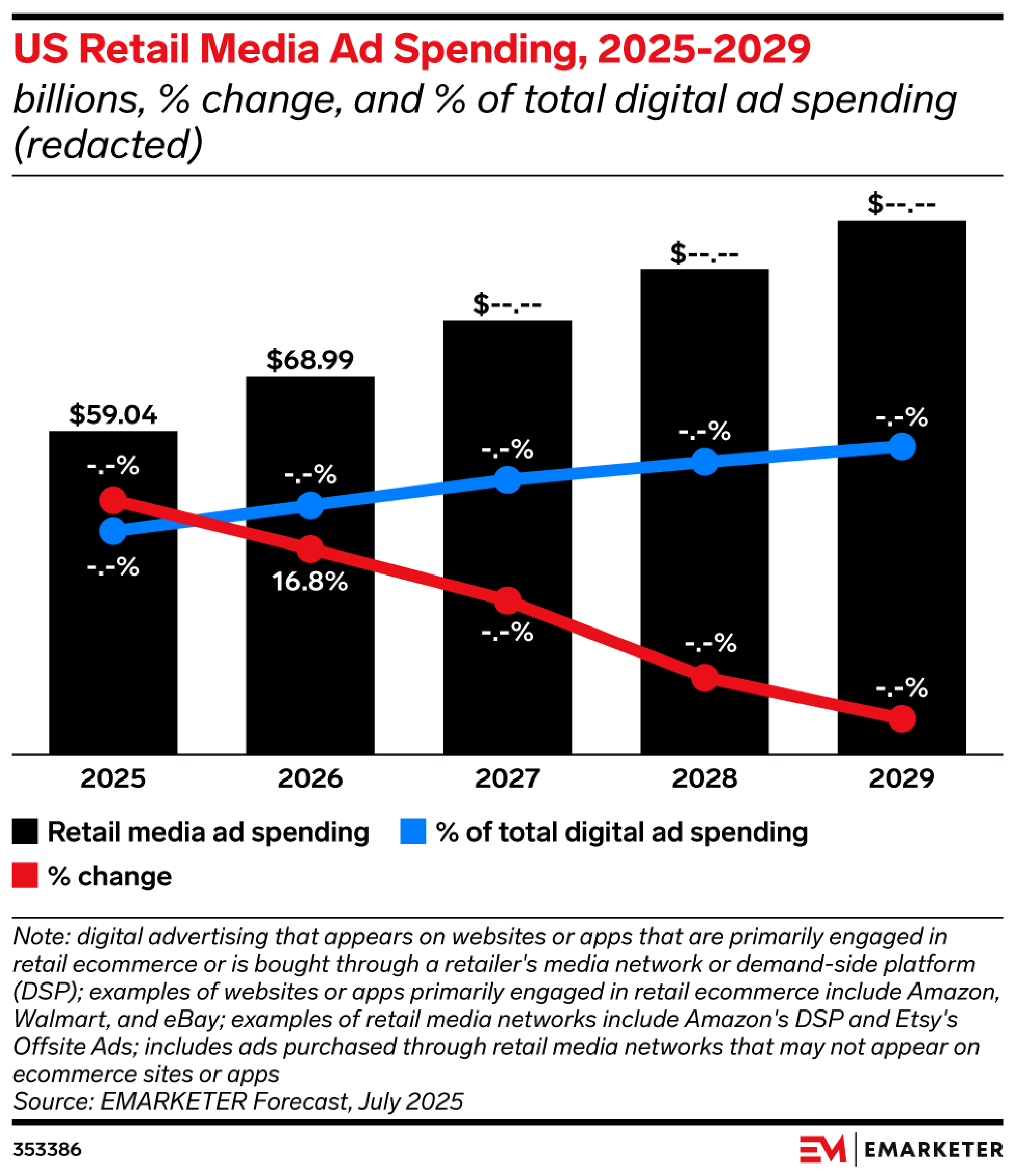

billions, % change, and % of total digital ad spending (redacted)

US Retail Media Ad Spending, 2025-2029

Advertiser budgets are limited

billions and % change (redacted)

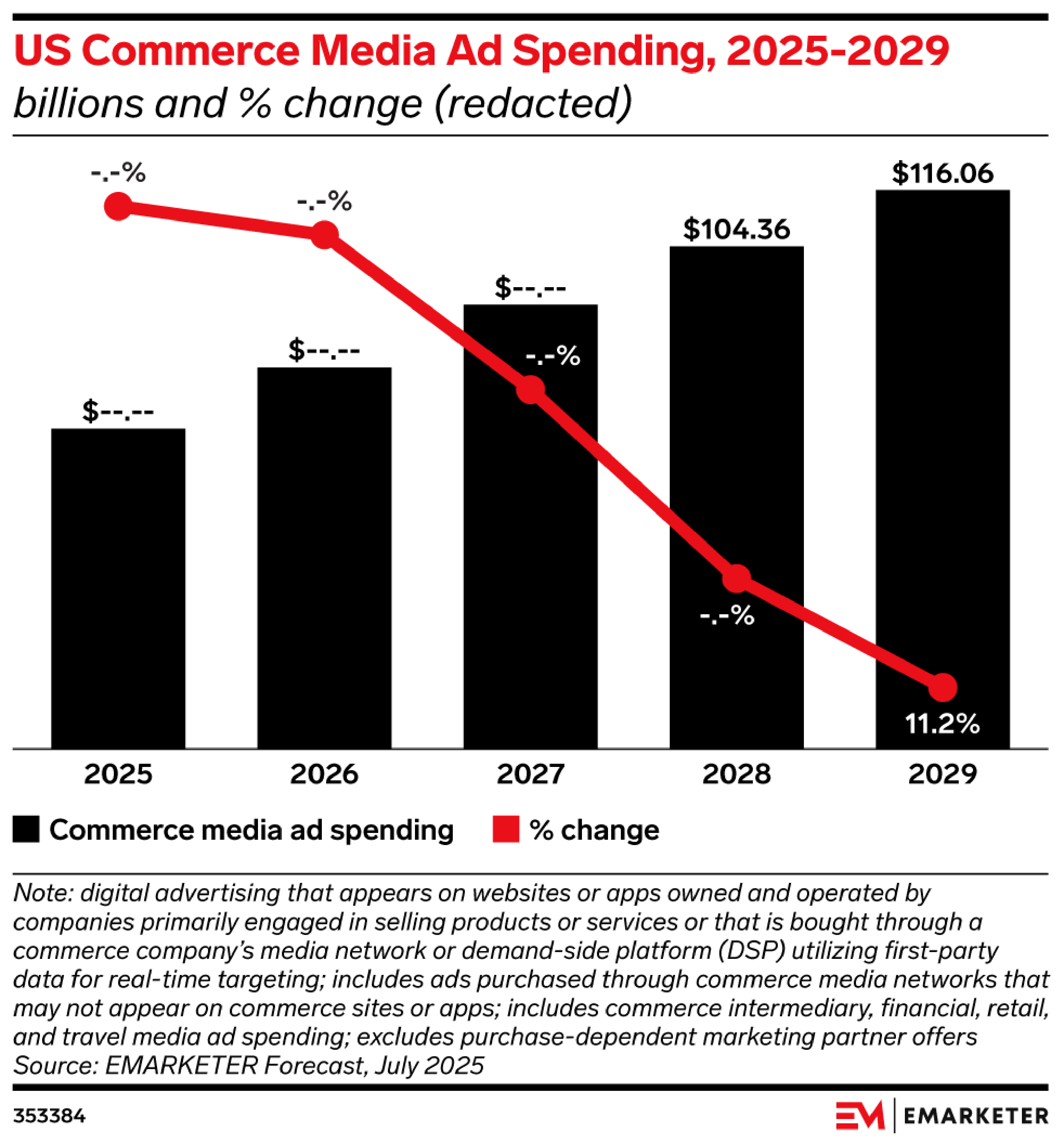

US Commerce Media Ad Spending, 2025-2029

Retail media revenue struggles to scale

Retail media networks (RMNs) are struggling to scale their revenues. Once RMNs establish on-site monetization, the next frontier is expanding into off-site, in-store, and non-endemic advertiser opportunities. However, growth beyond the basics requires tailored strategies that align with a retailer’s assets and audience. There is no one-size-fits-all approach—networks must assess which investments will produce scalable, sustainable returns while also differentiating themselves in a rapidly evolving market.

Retail media’s rapid growth is showing its limits—especially in on-site advertising. Amazon and Walmart have monetized nearly every inch of digital real estate, with sponsored results appearing on 99% of product search pages, according to a Pentaleap report. This saturation risks diminishing returns and user fatigue. Smaller RMNs face their own ceiling: limited traffic and fewer pages to monetize. With ecommerce traffic unevenly distributed and advertisers increasingly scrutinizing bottom-funnel ROI, relying solely on on-site is no longer a growth strategy.

To grow, RMNs are turning to off-site formats like programmatic display, social, and connected TV. We forecast off-site retail media ad spending will reach $26.02 billion by 2029, more than doubling 2025’s $12.33 billion. But the shift to off-site introduces complexity. There’s added competition from Meta and Google, measurement and attribution is harder to track, and off-site margins are lower—just 20% to 40% compared with 70% to 90% for on-site, according to Boston Consulting Group—due to reliance on third-party platforms and tools like data clean rooms.

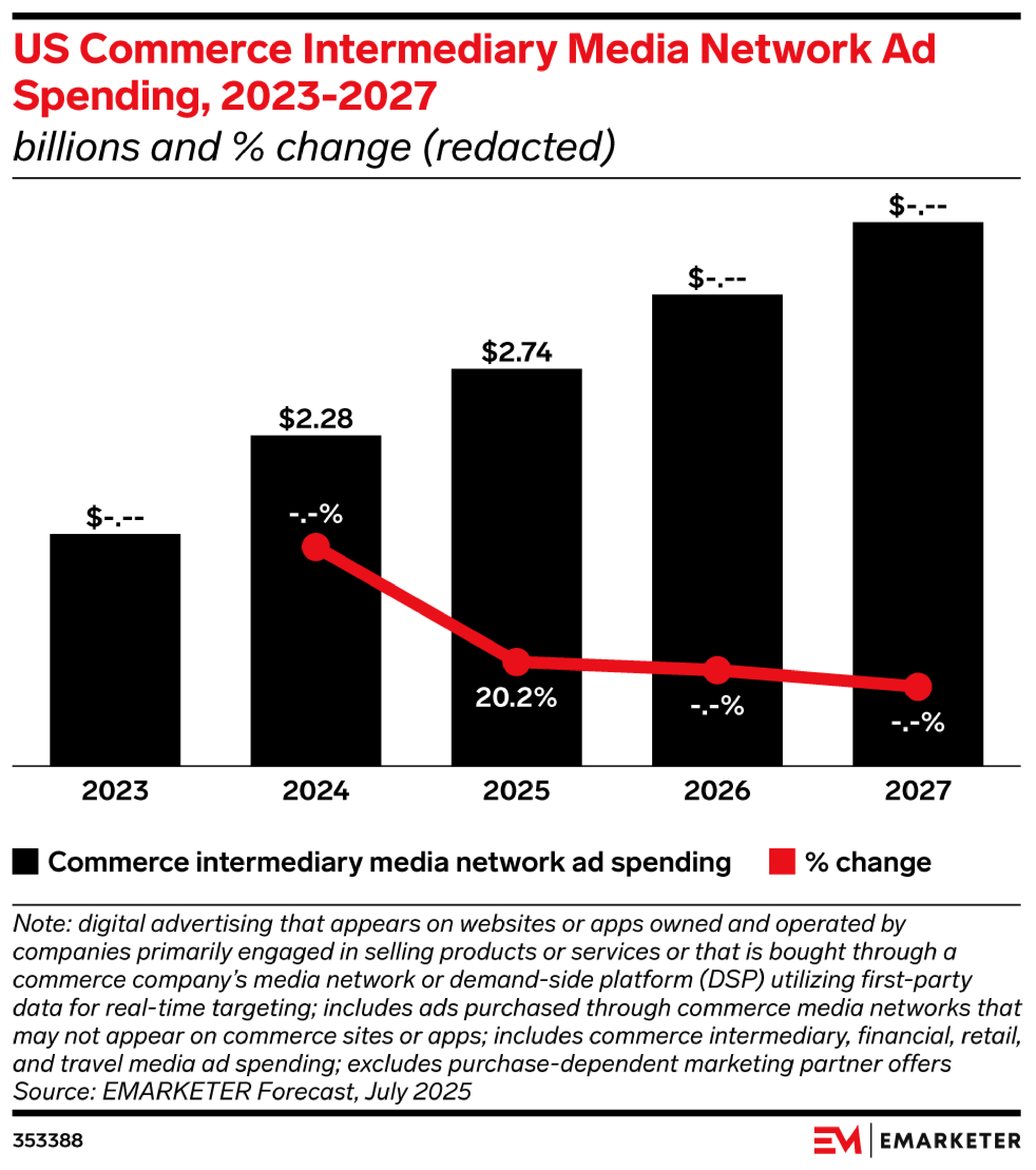

billions and % change (redacted)

US Commerce Intermediary Media Network Ad

Spending, 2023-2027

Nonretailers face fierce competition

Note: digital advertising that appears on websites or apps that are primarily engaged in retail ecommerce or is bought through a retailer's media network or demand-side platform

(DSP); examples of websites or apps primarily engaged in retail ecommerce include Amazon, Walmart, and eBay; examples of retail media networks include Amazon's DSP and Etsy's Offsite Ads; includes ads purchased through retail media networks that may not appear on ecommerce sites or apps

Source: EMARKETER Forecast, July 2025

�

353386

Note: digital advertising that appears on websites or apps owned and operated by companies primarily engaged in selling products or services or that is bought through a commerce company's media network or demand-side platform (DSP) utilizing first-party data for real-time targeting; includes ads purchased through commerce media networks that may not appear on commerce sites or apps; includes commerce intermediary, financial, retail, and travel media ad spending; excludes purchase-dependent marketing partner offers Source: EMARKETER Forecast, July 2025

353384

Note: digital advertising that appears on websites or apps owned and operated by companies primarily engaged in selling products or services or that is bought through a commerce company's media network or demand-side platform (DSP) utilizing first-party data for real-time targeting; includes ads purchased through commerce media networks that may not appear on commerce sites or apps; includes commerce intermediary, financial, retail, and travel media ad spending; excludes purchase-dependent marketing partner offers Source: EMARKETER Forecast, July 2025

353388

What’s the challenge?

On-site inventory is nearing its ceiling.

Off-site expansion promises scale, though not without trade-offs.

One of the biggest pain points for advertisers remains a lack of cross-network measurement standards. Over half (55%) of advertisers cite the lack of standardization as their top challenge in retail media, according to an Association of National Advertisers survey. Without consistent metrics, it’s hard to compare performance across networks—putting smaller RMNs at a disadvantage. Some networks are responding. For example, Albertsons is rolling out APIs to integrate campaign data into marketers’ dashboards, and Best Buy is laying first-party data over Meta buys to improve attribution.

Gaps in standardization �undermine efficiency.

Despite retail media’s explosive growth, Amazon and Walmart command the majority of spending, leaving limited room for others. Amazon is projected to capture over 78.0% of RMN ad spending through 2027, while Walmart is the second-largest and fastest-growing RMN that we track. Their scale puts pressure on advertisers to prioritize proven platforms and pushes smaller RMNs to innovate and differentiate their offerings. As a result, brands face tough decisions about how to stretch their budgets across a fragmented landscape.

Budget concentration forces �hard choices.

RMNs are competing for limited advertiser budgets in an increasingly competitive landscape. Despite the rapid growth of RMNs in the US, retail media ad budgets are heavily concentrated with Amazon and Walmart. �As more networks vie for a finite pool of advertiser dollars, marketers must make tough decisions about where to allocate spend. This has created a high-stakes environment where RMNs must prove their performance and justify their unique value amid overlapping offerings �and budget constraints.

What’s the challenge?

Proving value beyond performance.

Retail media’s strength has been bottom-funnel performance—but many advertisers expect evidence of impact throughout the funnel. As upper-funnel metrics like brand lift and engagement grow in importance, RMNs must offer richer data and attribution tools. In fact, 71% of marketers cite advancements in analytics, attribution, and measurement as their greatest opportunity in 2025, according to NCS Solutions. RMNs that can deliver on a broad set of KPIs will have a better chance of success in a limited-budget environment.

Commerce intermediaries, financial service providers, and travel brands are becoming dominant players, but each faces distinct challenges. Commerce intermediaries like Instacart and Uber Eats are forecast to reach $3.55 billion in ad spending by 2027, growing at a 24.5% CAGR, driven by shopper engagement and partnerships. Financial media networks (FMNs) like PayPal and Klarna offer valuable cross-merchant data and integrations, but regulatory scrutiny may be an obstacle. While the smallest subcategory tracked in our forecast, FMNs are expected to grow from $640 million in 2025 to $1.8 billion in 2027. Meanwhile, travel media networks (TMNs) like Expedia and Kinective Media by United Airlines bring contextual, high-intent audience targeting. We forecast ad spending on TMNs will grow from $1.80 billion to $2.35 billion in 2027, largely driven by non-endemic advertiser interest.

Category leaders are emerging, �with each facing unique hurdles.

We forecast nonretail commerce media ad spending will grow 82.46% between 2025 and 2027, reaching $13.21 billion. The bump in ad spending will be fueled by financial services, travel, commerce intermediaries, and other verticals. However, retail media—primarily Amazon and Walmart—will still represent 89.2% of commerce media ad spend in 2025, capturing the bulk of investment. To gain ground, nonretail players must grow fast and earn recognition from advertisers who still associate commerce media with retail.

Growth is strong, �but retail dominates.

Nonretail sectors must sharpen their pitch to compete in a retail-dominated commerce media landscape. As retail media’s share of digital ad spending grows, non-traditional sectors—like financial services, travel, and telecom—are looking to take advantage of the commerce media opportunity. These players bring unique data sets, like cross-merchant purchase behavior or high-intent customer journeys, but must work harder to define and communicate their value to advertisers. In a field where retailers command the lion’s share of investment and attention, nonretail entrants must prove their relevance and compete for limited media dollars.

What’s the challenge?

Challenge 1

xx

Top

01

02

03

end

Challenge 2

Challenge 3

How Policy Shifts—from Tariffs to TikTok—Will Reshape Commerce and Advertising

Tapping non-endemic advertisers—brands that don’t sell through the �retailer—offers a new revenue path, particularly for smaller RMNs. Most retailers are still testing non-endemic formats like off-site banners or post-purchase placements. Measurement is another hurdle. Non-endemic ads aren’t tied to direct conversion data. Instead, measurement often relies on softer metrics like clicks and impressions. Growth in non-endemic partnerships will depend on stronger data collaboration and clearer value stories, especially as commerce media expands across retail, travel, and finance.

Non-endemic opportunities are emerging, but it’s no silver bullet.

Advertisers are projected to spend $2.35 billion in 2025 on “other” nonretail commerce media categories like fitness, entertainment, and automotive. That figure will climb to $5.23 billion by 2027, making it the largest nonretail commerce media category by ad spending. Though still new and fragmented, these networks are attracting investment. With limited inventory across commerce media, advertisers can help shape its growth by forging partnerships, expanding supply, and connecting the right platforms and intermediaries.

The long tail of commerce media is taking shape, despite fragmentation.

The commerce media landscape is shifting fast—and success depends �on sharp insights and smarter planning.

�With EMARKETER’s forecasts, analysts’ insights, and real-world data, you’ll understand where budgets are moving, how networks are evolving, and which players are gaining ground. Use our guidance to sharpen your strategy, find your edge, and stand out in a crowded field.

Keep pace with commerce media

Commerce Media’s $100 Billion Future—

and What Could �Get in the Way

Sales Inquiries: �sales@emarketer.com

Advertising and Sponsorships: advertising@emarketer.com

�

Principal Analyst, EMARKETER

Sarah Marzano

“Nonretail commerce media is one of the most dynamic areas of growth, but it faces a steep uphill battle for share of mind and wallet. Financial, travel, and intermediary networks must sharpen their value stories, leaning on unique data advantages to stand apart in a market still dominated by retail. The opportunity is real, but it demands clarity, speed, and a willingness to innovate beyond the retail media playbook.”

Principal Analyst, �EMARKETER

Sarah Marzano

Principal Analyst, EMARKETER

Sarah Marzano

“Advertisers are juggling more networks than ever with finite budgets, and the dominance of Amazon and Walmart means every other player must fight for share. Networks that can ease the process of buying and reporting on retail media and show clear evidence of brand-building impact will be best positioned to win the trust and spend of advertisers operating in a resource-constrained environment.”

Principal Analyst, �EMARKETER

Sarah Marzano

Principal Analyst, EMARKETER

Sarah Marzano

“Retail media has reached an inflection point. On-site monetization has limited runway, and networks that cannot effectively expand into off-site, in-store, or non-endemic advertising risk stalling out. The winners will be those that tailor their strategies to their unique assets and audiences rather than chasing a one-size-fits-all playbook in order to unlock scalable growth in an increasingly crowded market.”

Principal Analyst, �EMARKETER

Sarah Marzano

Commerce media ad spending is forecast to surpass $100 billion by 2028, reaching as high as $116 billion by 2029.

Retail media will account for 16.8% of total digital ad spending in 2026.

Commerce intermediary ad spending is projected to reach $2.74 billion in 2025, a 20.2% increase from 2024.

Log in to see the�unredacted chart

Log in to see the�unredacted chart

Log in to see the�unredacted chart

Log in to see the�unredacted chart

Log in to see the�unredacted chart

Log in to see the�unredacted chart

Challenge 1 Content:

Retail Media’s Off-Site Imperative

Future-Proofing Retail Media for the Next Chapter

Non-Endemic Advertising Explainer 2024

Resources

Challenge 2 Content:

2025 Commerce Media Trends To Watch

Retail Media Forecast Update H1 2025

The State of Measurement in Retail Media

Amazon’s retail media ad revenues will pass $60 billion in 2025, highlighting its continued dominance

Advertisers push for standards as retail media refines measurement

Challenge 3 Content:

Commerce Media Ad Spending Forecast 2025

US Commerce Media Forecast 2025

Commerce Media Explainer 2024

Commerce Media Trends and Opportunities | Behind the Numbers: Special Edition

Want more insights like this?

EMARKETER provides the gold standard for media, advertising, and commerce data with thousands of ready-made forecasts, charts, and reports. Get to decision-making faster with access to exclusive data sets, expert insights, interactive forecasts – and now AI Search: a faster, smarter way to navigate and contextualize EMARKETER research.

Contact Our Team

Contact Our Team